Condo Insurance in and around Albuquerque

Looking for excellent condo unitowners insurance in Albuquerque?

State Farm can help you with condo insurance

Condo Sweet Condo Starts With State Farm

Your condo is your retreat. When you want to slow down, relax and wind down, that's where you want to be with family and friends.

Looking for excellent condo unitowners insurance in Albuquerque?

State Farm can help you with condo insurance

Why Condo Owners In Albuquerque Choose State Farm

You want to protect that significant place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as hail, weight of ice or snow or wind. Agent Jessica Romero can help you figure out how much of this wonderful coverage you need and create a policy that is right for you.

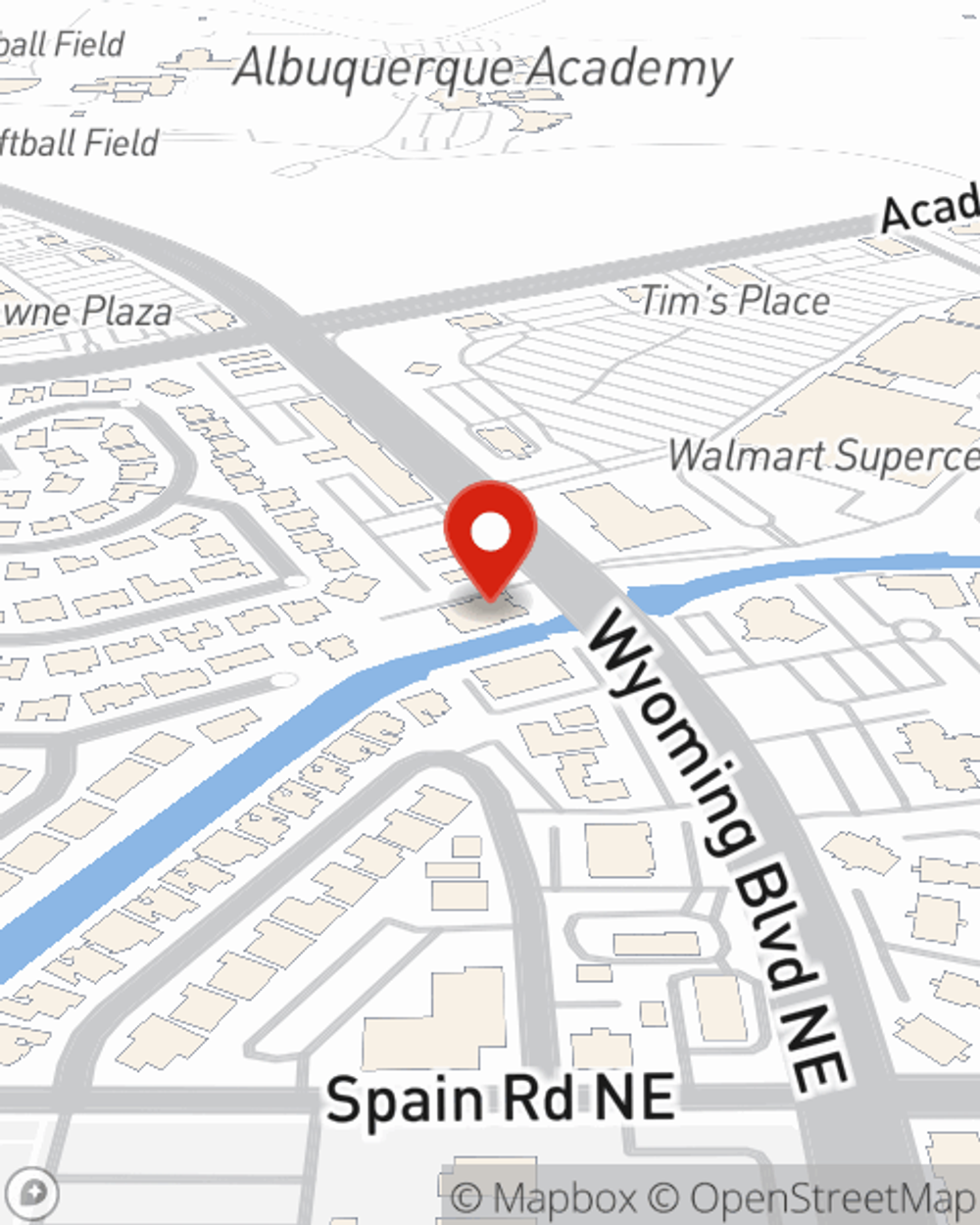

When your Albuquerque, NM, condo is insured by State Farm, even if life doesn't go right, State Farm can help guard your one of your most valuable assets! Call or go online now and discover how State Farm agent Jessica Romero can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Jessica at (505) 821-6000 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Jessica Romero

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.